nanny tax calculator texas

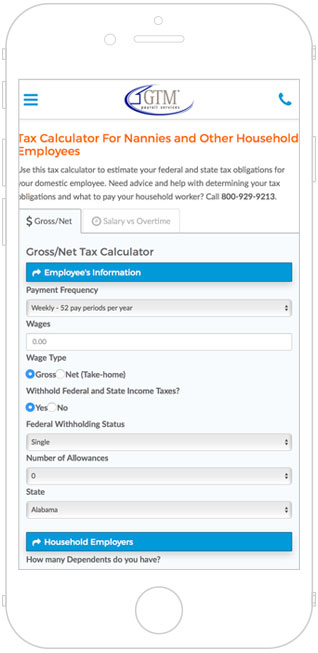

GTM Payroll Services provides this calculator as a means for obtaining an estimate of tax liabilities but should not be used as a replacement for formal calculations and does not. Good news though NannyPay offers a low-cost and up-to-date software solution for calculating nanny taxes and preparing annual Form W-2s and Schedule H up to 3 employees at no.

Nanny Tax Calculator Gtm Payroll Services Inc

You can use our Texas Sales Tax Calculator to look up sales tax rates in Texas by address zip code.

. Ad Free Avalara tools include monthly rate table downloads and a sales tax rate calculator. This is based on the 20222023 tax year using tax code 1257Lx and is relevant for the period up to and including 050722 this will be updated again. Ad 100s of Top Rated Local Professionals Waiting to Help You Today.

Ad Payroll So Easy You Can Set It Up Run It Yourself. Our easy-to-use budget calculator will help you estimate nanny taxes and identify potential tax breaks. Compare Tax Preparation Prices and Choose the Right Local Tax Accountants For Your Job.

Taxes Paid Filed - 100 Guarantee. Our new address is 110R South. The Nanny Tax Company has moved.

Cost Calculator for Nanny Employers. Calculate your tax refund for free. This calculator assumes that you pay the nanny for the full year.

These look something like. You are responsible for federal employment taxes when you pay household workers as little as 1000 in a calendar quarter or when you pay any individual employee age 18 or over 2400 in. Easy-to-use nanny tax calculator provides estimate of tax responsibility for a householder employer and tax withholdings for nanny or other domestic worker.

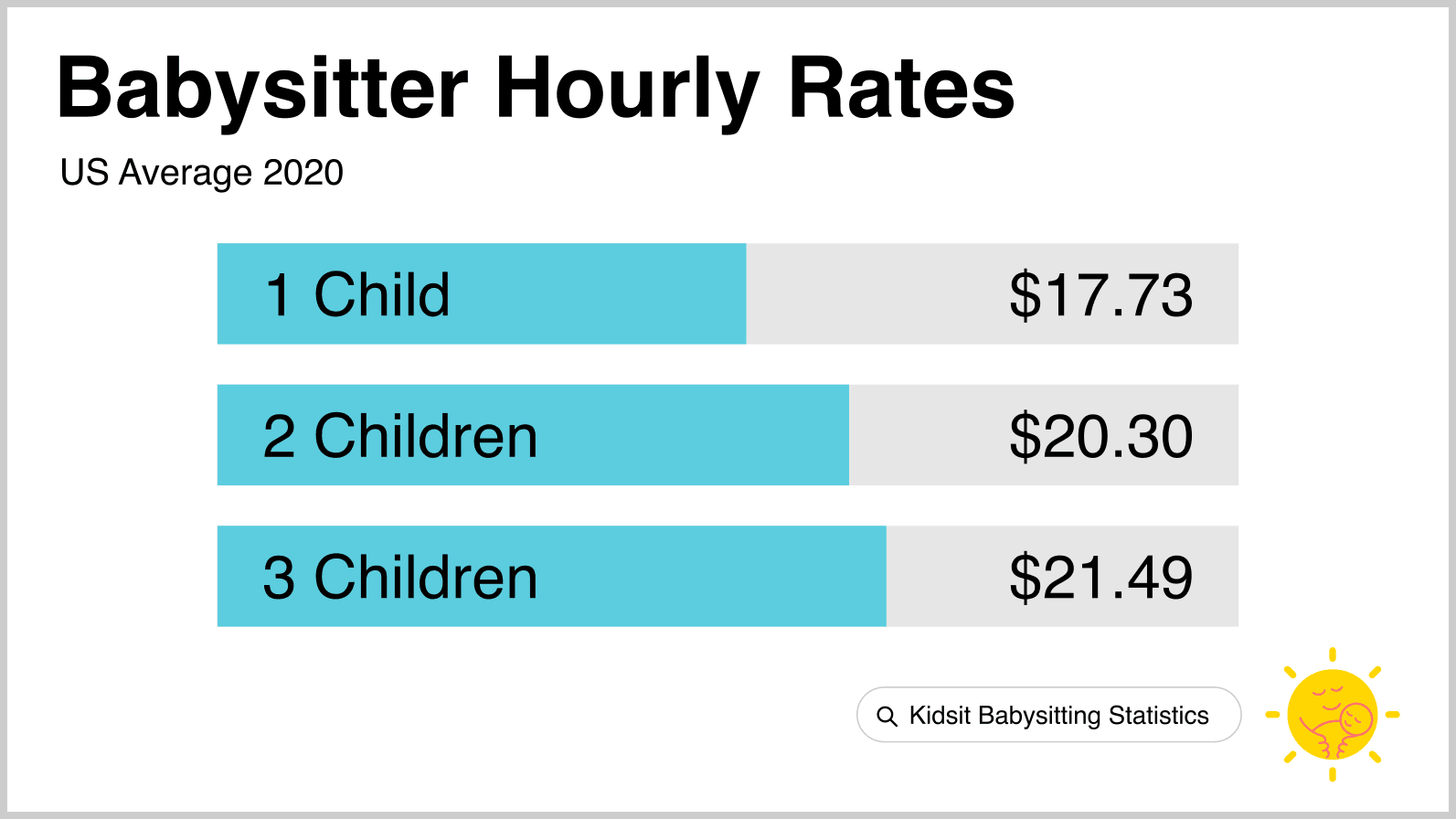

With the minimum wage in Texas being 725 per hour you can expect to pay a hourly rate between 725 and 20. Choose Avalara sales tax rate tables by state or look up individual rates by address. Then print the pay stub right from the calculator.

Our Easy-To-Use Budget Calculator Will Help You Estimate Nanny Taxes. Nanny taxes include Social Security and Medicare FICA and federal and state unemployment. Use The Nanny Tax Companys hourly nanny tax calculator to calculate nanny pay and withholding.

This calculator is intended to provide general payroll estimates only. Nanny taxes see our detailed guide on what nanny taxes are and if you have to pay them Nanny tax payroll service for calculating taxes and. Nanny tax calculator for nannies.

Choose Avalara sales tax rate tables by state or look up individual rates by address. A nanny tax calculator will help you learn what your take-home pay will be when negotiating your pay rate. Form C-20 or C-20F for annual filing.

Calculate pay and withholdings using The Nanny Tax Companys hourly nanny tax calculator or salary calculator. Payroll taxes in Texas are. Premium federal filing is 100 free with no upgrades.

These are called nanny taxes. Nanny Tax Hourly Calculator. On a quarterly basis.

Get your FREE step-by-step guide to managing Nanny Tax Payroll. Nanny Agencies in Texas. Enter your info to see your take home pay.

The calculator will show you the total sales tax amount as well as the county city and. For specific tax advice and guidance please call us toll free at 877-626-6924 and a NannyChex. Ad Free means free and IRS e-file is included.

Taxes Paid Filed - 100 Guarantee. Our Easy-To-Use Budget Calculator Will Help You Estimate Nanny Taxes. Most families pay about 9-12 of their nannys wages in.

SmartAssets Texas paycheck calculator shows your hourly and salary income after federal state and local taxes. However in most situations you need to pay 06 for unemployment insurance for the first 7000 you pay your nanny. If you pay your nanny cash wages of 1000 or more in a calendar quarter or 2400 in a calendar year file Schedule H.

Please tick this box if you would like to receive advice and relevant news on employing and working with nannies and. Ad Payroll So Easy You Can Set It Up Run It Yourself. Max refund is guaranteed and 100 accurate.

There is a difference between net and gross pay. The average cost of a nanny in Texas is 1272 per hour. The Nanny Tax Company has.

Ad Free Avalara tools include monthly rate table downloads and a sales tax rate calculator.

Nanny Tax Calculators Nanny Payroll Calculators The Nanny Tax Company

Nanny Payroll Services For Households Adp

W 4 Forms For Nannies And Caregivers Care Com Homepay

Babysitting Pay Rates How Much Should You Charge

Tax Guide For Paying Household Employees

Nanny Tax Payroll Calculator Gtm Payroll Services

![]()

Texas Nanny Tax Rules Poppins Payroll Poppins Payroll

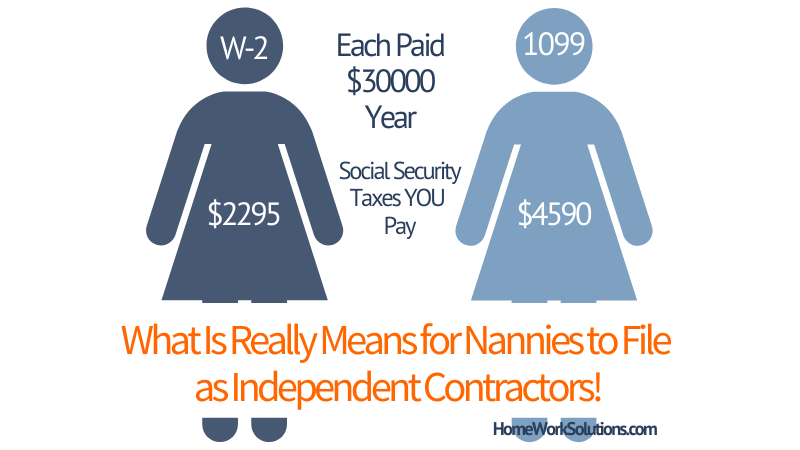

How Does A Nanny File Taxes As An Independent Contractor

Breaking The Barriers To Legal Pay Nanny Magazine

Nanny Tax Payroll Calculator Gtm Payroll Services

Common Nanny Tax Questions Poppins Payroll Poppins Payroll

Texas Nanny Tax Rules Poppins Payroll Poppins Payroll

Deducted A Nanny As A Business Expense Homework Solutions

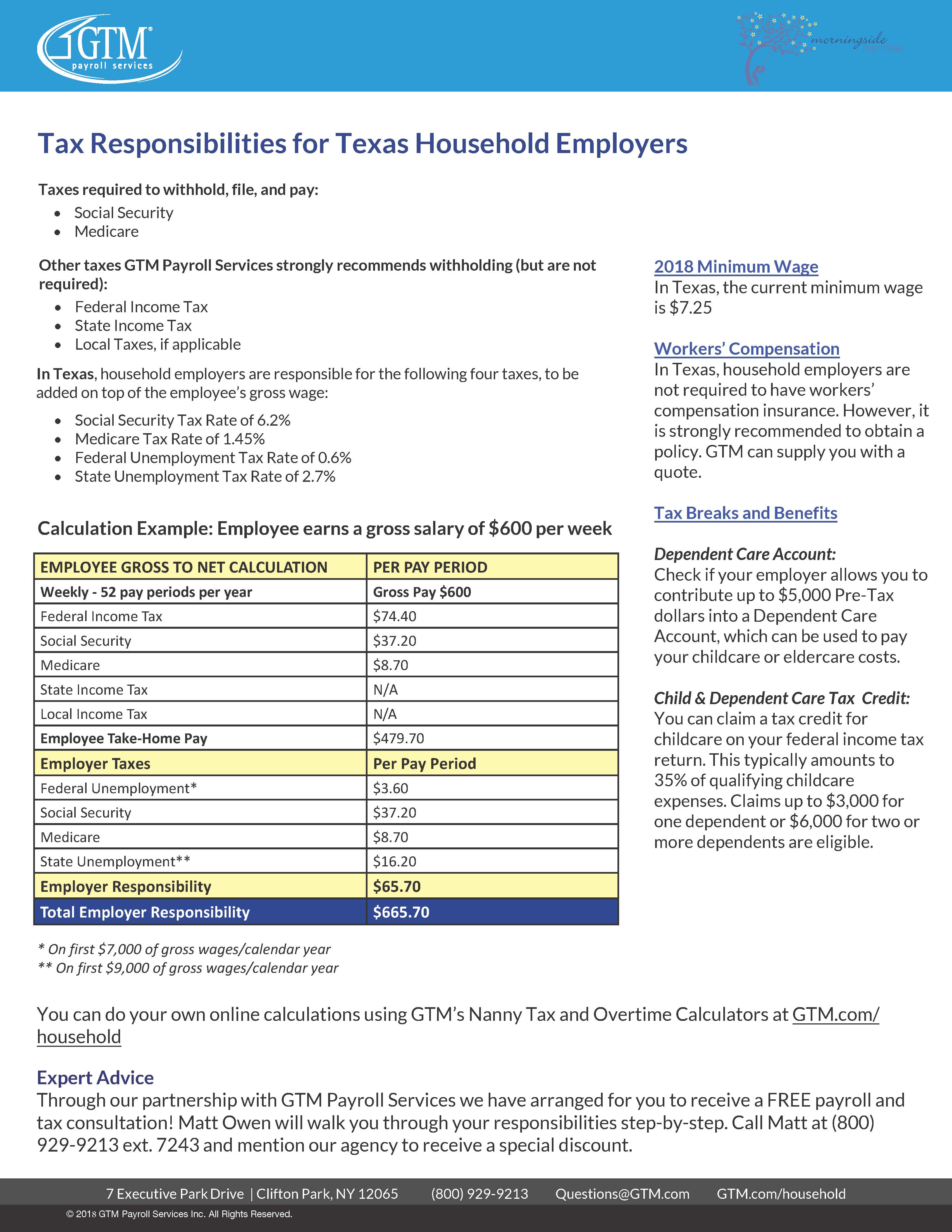

2018 Nanny Tax Responsibilities

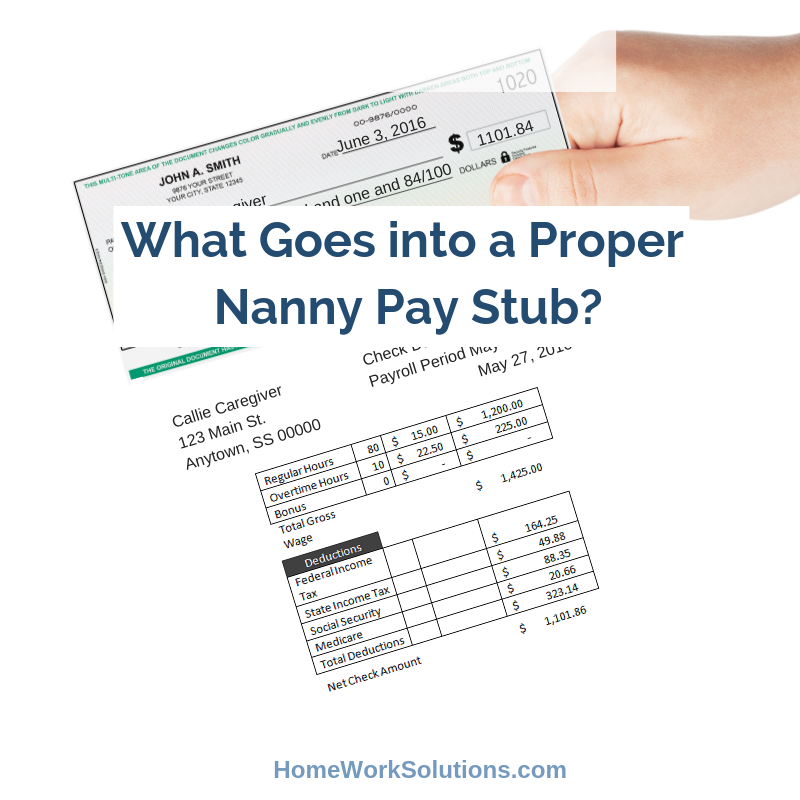

What Goes Into A Proper Nanny Pay Stub

Nanny Tax Threshold For 2021 Sees Slight Increase Of 100

Nanny Tax Payroll Calculator Gtm Payroll Services

Nanny Taxes Q A Who Owes Who Pays H R Block Newsroom

The Diy Household Employee Payroll Service Simple Nanny Payroll